Abstract

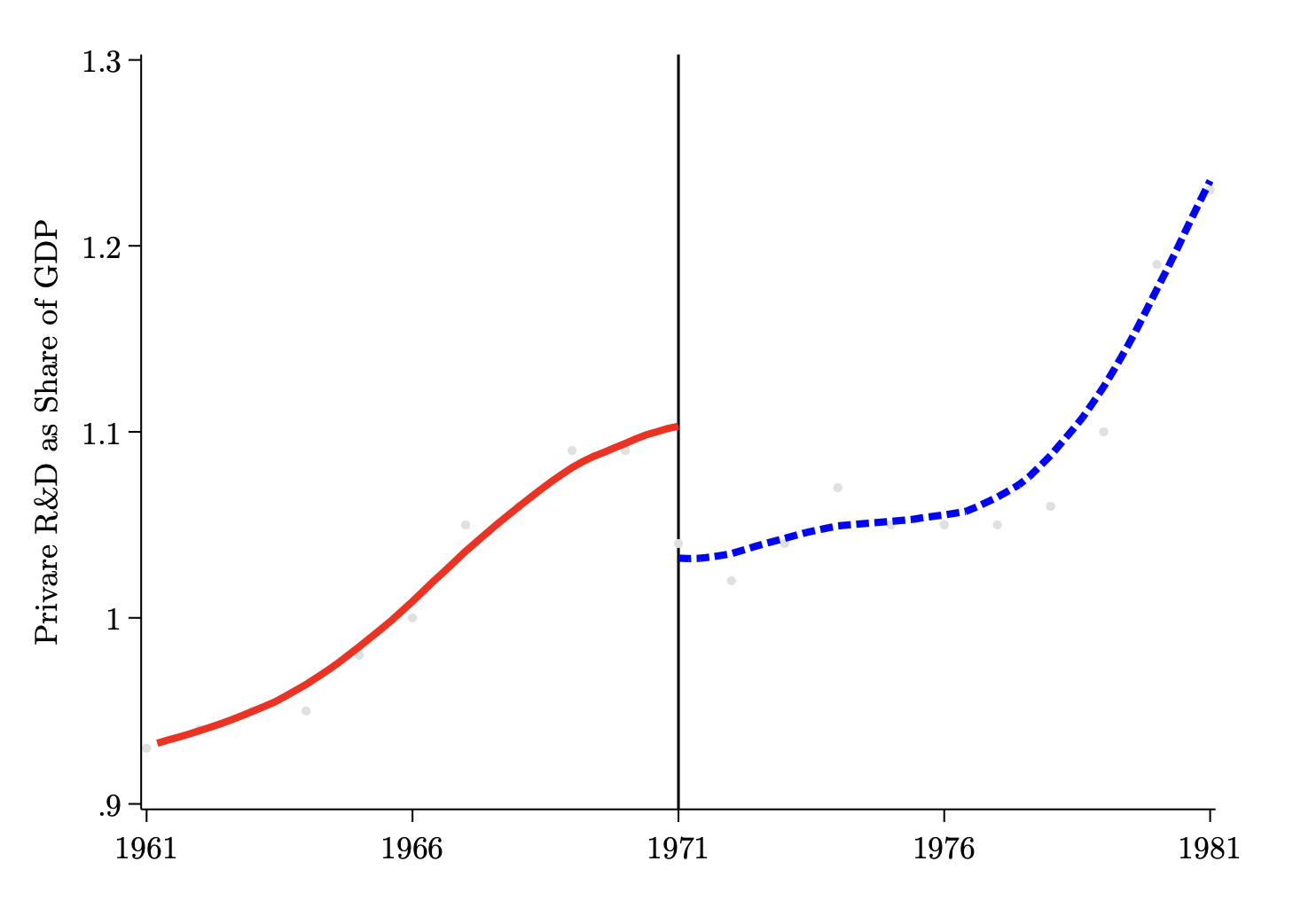

Richard Nixon’s action ending the convertibility into dollars for gold on August 15, 1971 marked a historic break in U.S. monetary policy. We know retrospectively that Nixon’s action was followed by decades of above-trend inflation, but did his action have short-run impacts? We demonstrate that one immediate effect was increased policy uncertainty and we measure its impact on private R&D. Because R&D’s returns depend heavily on future market and government stability, policy uncertainty should discourage R&D expenditures. Our interrupted time-series design examines private R&D trends prior and subsequent to the Nixon Shock. We conclude that uncertainty induced by this event accounts for at least one-fifth and possibly up to one-half of a standard deviation decline in the quantity of R&D by private organizations.

Figures 1: Effect of Uncertainty on Private R&D as a Share of GDP

Citation

Fuller, Caleb S., and Nicholas Pusateri. “Turmoil of the times: measuring the impact of the nixon shock on r&d” Working Paper (2022).